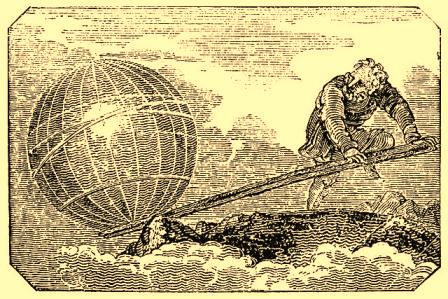

Give me a place to stand on, and I will move the Earth.

-- Archimedes of Syracuse c.287 BC-c.212BC

|

|

Give me a place to stand on, and I will move the Earth.

-- Archimedes of Syracuse c.287 BC-c.212BC

| leverage noun: 1. the mechanical advantage gained by being in a position to use a lever 2. competitive advantage (variously derived from proprietary technology, trade secrets, patents, market share); 3. political power (expoiting name recognition, campaign war chest, vote-trading); 4. investing with borrowed money as a way to amplify potential gains (at the risk of greater losses). |

In its literal meaning (Sense 1), nothing. You have your 'load', your 'effort', and your 'fulcrum'. Neat. Oh, well, the word has become a bit shopworn through careless repetition in business, but no big deal. Indeed, the first page of every business plan seemingly must assert leverage at least once (Sense 2). Likewise, public figures would be all but speechless without political leverage (Sense 3). Still, most of its figurative applications do have descriptive alternatives based on a key concept -- advantage. During my adult lifetime, one metaphorical meaning (Sense

4) has -- well, leveraged the word into an ugly expression.

The so-called "leveraged buy-out" (LBO) dates back to the late '60s and,

in my opinion, holds primacy among financial stratagems as uncreative,

destructive, and motivated entirely by greed.

Having become a mangled metaphor, 'leverage' (the 'L'

in LBO) is a word I can do without.

|

| lever

1297, from Old French. levier "a lifter, a lever," agent noun from lever

"to raise," from Latin.

levare "to raise," from levis "light"

in weight, from Proto-Indo European base *le(n)gwh- "light,

easy, agile, nimble" (cf. Scottish. laghuh "quick, small;" Greek.

elakhys

"small,"

elaphros

"light;"

Old Church Slavonic. liguku, Lithuanian.

lengvas "light;"

Old Irish laigiu "smaller, worse;" Gothic.

leihts, Old English

leoht

"light"

(adj.)). Leverage "action of a lever" is first recorded 1724; figurative

sense is from 1858; financial speculation sense is from 1937.

-- Online

Etymology Dictionary

© November 2001 Douglas Harper |